We’ve heard that most LPs would prefer a more simplified MLP composition. What’s better is that simple is also more secure, with more liquidity. One that focuses on the blue chip assets such as BTC, ETH and LINK whilst reducing long tail assets and limiting exposure to USDT. The challenge here is in balancing assets between traders who desire more assets to trade on-chain, and LPs looking to manage risk with the biggest digital assets. Whether part of a delta neutral strategy, simplification of risk, or a desire to concentrate on assets with more liquid markets, all valid reasons for the change.

We’re doubling down on our long term commitment to building stronger on-chain tools for traders.

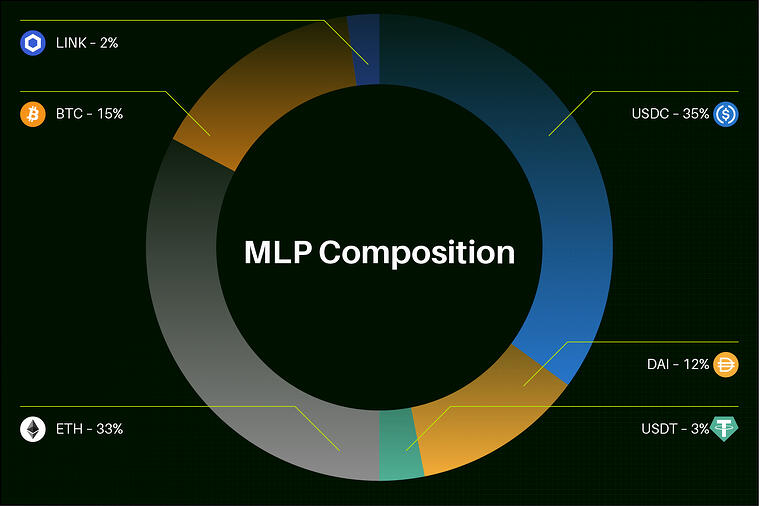

So here is the change we are making. New MLP Composition:

- 35% — USDC

- 12% — DAI

- 3% — USDT

- 33% — ETH

- 15% — BTC

- 2% — LINK

Commencing this week, we are deprecating other assets currently supported in the MLP Composition (UNI, FRAX, FXS, BAL and CRV). During this transition period, there will be a gradual reduction in support for these assets. Meaning there will be increasing limits to trading the assets, and full support to swap the assets for USDC, DAI, USDT, ETH, BTC and LINK, both directly and through aggregators like OpenOcean, until they hit zero composition and are removed entirely from MLP. The transition period may cause some volatility in MLP - which we will actively be monitoring in order to ensure it is performing as expected.

We look forward to further supporting our LPs who will now be able to generate a more accurate, predictable and safer return. Additionally, there will be a simpler ability to create delta neutral vault strategies on top of MLP due to no longer needing to hedge longer-tail, lower liquidity assets on other DeFi platforms.